Options trading is buying and selling of financial contracts known as options. These contracts provide the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specified timeframe. Traders use options for speculation, risk management, and income generation, employing various strategies to achieve their financial goals. There are two types of Options namely Call Option and Put Option.

| Understanding Options Trading |

| Options Trading with Real-World Example |

| Types of Options Trading |

| Things to Know Before Starting Options Trading |

| Introduction to Call Option |

| Introduction to Put Options |

| Factors Affecting the Price of Options |

| Basic Strategies in Options Trading |

Understanding Options Trading

You are a property investor who wants to buy a land for Rs.75 lakh. You expect the land price to go up to Rs.1 crore in the next six months. This will happen only if the city bus stand gets relocated to this area. Although you are enthusiastic about this deal, you are also scared that the bus stand relocation could get canceled or further delayed.

So instead of buying the land right away, you make a deal with the landowner. As a property investor, you give a non-refundable fee of Rs.10 lakh to the landowner and get into an agreement. According to the agreement, you can decide to buy the piece of land or not in the next six months. If you want to purchase the land by then, the landowner will have to sell the land at the price you have fixed today (Rs.75 lakh). But if you decide not to buy the land six months down the lane, then the landowner can keep the Rs.10 lakh non-refundable fee you have paid for the agreement.

Unlike the Futures contract where a deal is mandated to be honored, the Options contract gives the right for the buyer to rethink their decision at the end of the contract’s period. So in the above scenario, you have bound the landowner into an obligation to sell the piece of land in the next six months (1st of July) only if you decide to exercise your right.

Here is a closer look at the details of the agreement between you and the landowner.

- You pay a non-refundable fee of Rs.10 lakh today to get the landowner into the deal.

- Against the fee, the landowner agrees to sell the land after 6 months to you.

- The price of the sale is fixed today at Rs.75 lakh.

- Since you’ve paid the upfront fee, only you can decide to call off or honor the deal at the end of 6 months.

- Even if the landowner wants to call off the deal or sell the piece of land to you, he cannot.

- If you call off the deal at the end of six months, the landowner gets to keep the non-refundable fee.

So who do you think is going to make the profit here? It purely depends on the outcome of the city bus stand relocation. You and the landowner should wait for the next six months to know what would happen next.

However, irrespective of the land price, there are only three potential outcomes that could happen at the end of the deal.

- By the end of six months (1st July), the city bus stand comes up to the new location. The price of the land shoots up to Rs.1 crore.

- The city bus stand gets relocated to somewhere else. Due to speculations and disappointment among people, the price of the land falls to Rs.50 lakh.

- City bus stand relocation is delayed unconditionally so the price stays flat at Rs.75 lakh.

While making an exact land price prediction can be challenging, the potential outcomes typically fall into the categories of positive, negative, or neutral results. Based on this, we will see how you, as a property investor, will react to the deal by the end of six months.

Scenario 1: The land price goes up to Rs.1 crore

During the six months, the city bus stand gets relocated to the area, resulting in a drastic increase in the land price. Now it is time for you to decide whether you want to honor or call off the contract. Since what you’ve predicted (the land price to go up) has happened, you will mostly execute the deal.

The current market price of the land is Rs.1 crore.

The agreement price is Rs.75 lakh.

This means that you can buy the land for Rs.75 lakh and sell it for Rs.1 crore (current market price) and make a profit. Since you’ve made the deal and paid a non-refundable fee of Rs.10 lakh for the land, the landowner is obliged to sell the land at a lesser value than the market price.

How much do you make as a profit by honoring the contract? Here is how you calculate it.

Buy price (according to the agreement)- Rs.75 lakh

Upfront fee (non-refundable)- Rs.10 lakh

Total spent- Rs.85 lakh

Current market value of the land (selling price)- Rs.1 crore

Your profit = Selling price – total expense | Rs.1,00,00,000-Rs.85,00,000 = Rs.15,00,000

As a property investor, you make a profit of Rs.15 lakh from this deal.

Scenario 2: The land price goes down to Rs.50 lakh

It turns out that the city bus stand relocation has been cancelled. Due to people’s sentiment and uncertainity, the price of the land has gone down to Rs.50 lakh. So what will be your reaction to this scenario?

It doesn’t make any sense to buy a piece of land for a higher price than its current price. So you decide to walk out of the deal. Let’s do a calculation to validate your decision.

Buy price (according to the agreement)- Rs.75 lakh

Current market price of the land- Rs.50 lakh

Upfront fee (non-refundable)- Rs.10 lakh

So if you want to buy the land now, you will have to pay the agreement price on top of the previously paid upfront fee.

The money you spend on buying the land = Buying price (according to the agreement)+Upfront fee | Rs.75,00,000 + Rs.10,00,000 = Rs.85,00,000

If you decide to sell the land after buying, you can do it for only Rs.50 lakh.

Therefore, you could make a loss of Rs.35 lakh in this deal. Instead of executing this and making a larger loss, you decide to walk away from the agreement. As a result, you will lose the upfront non-refundable fee you’ve paid for the land (Rs.10 lakh).

Scenario 3: The land price stays stable at Rs.75 lakh

Soon after the announcement of the bus stand relocation, the municipality decided to delay it unconditionally. Because of this, the price of the land has stayed the same (Rs.75 lakh) for six months.

What will you do here? If you execute the contract and buy the land for Rs.75 lakh, you will get the chance to sell it without any profit.

But the twist is that you’ve paid an upfront fee of Rs.10 lakh for the land six months prior. So your total expenditure on the land is Rs.85 lakh. Whether you decide to execute the contract or walk away from it, you make a loss of Rs.10 lakh. Mostly, people choose to call off the contract in such a situation and bear the minimum loss (upfront fee).

Let’s look at a few reasons you decided to onboard the contract.

- You expected the land price to go up drastically.

- If the price of the land remains flat or falls, you can walk out of the deal. Since you’ve paid an upfront fee, the maximum loss you have to bear is Rs.10 lakh in both scenarios.

- You took this risk because you believe that the chance of profitability is higher.

Options Trading with Real-world Examples

We are taking ‘Call Option’ to explore the real-world example. Assume that BANKNIFTY is trading at Rs.44,000. You are given the chance to buy the same stock one month later at Rs.44,200, doesn’t matter how much the price goes up during this period. Even if the stock price is at Rs.44,800, you can buy it for the previously agreed price.

In order to get this right, you are required to enter an Options contract by paying a nominal fee of Rs.1000 per stock. Usually, Options contracts have lot sizes. Let’s assume that the lot size of BANKNIFTY is 15 and it is expiring on the last Wednesday of the month. So you pay Rs.1000 (premium) x 15 (lot size). The total payment you have made is Rs.15,000 and have secured the right to buy BANKNIFTY stocks at the previously determined price of Rs.44,200. Let’s look at the three potential outcomes of this contract.

- The BANKNIFTY price goes up to Rs.47,000.

- The price goes down to Rs.43,800.

- The price remains stable at Rs.44,200.

Outcome 1: The BANKNIFTY price goes up to Rs.47,000

If the stock price goes beyond the purchased price, then the Call Option buyer makes a profit from it. Let’s calculate the Profit & Loss (P&L) scenario of this.

The price at which the deal was made- Rs.44,200 x 15 (lot size) = Rs.6,63,000

Premium paid- Rs.1000 for each stock | 1000 x 15 (lot size) = Rs.15,000

Expense incurred = Rs.6,63,000 + Rs.15,000 = Rs.6,78,000

Current market price of the stock = Rs.47,000 x 15 = Rs.7,05,000

Profit = Current price – Expense incurred | Rs.7,05,000 – Rs.6,78,000 = Rs.27,000

Through this Options contract, you make a profit of Rs.27,000. At the end of the deal, you also get to buy the stock for a much lower price than what is being traded at the moment.

Outcome 2: The BANKNIFTY price goes down to Rs.43,800

If the stock price goes below the price at which the deal was made, it is an evident loss for you. Let’s do the math to understand it better.

The price at which the deal was made- Rs.44,200 x 15 (lot size) = Rs.6,63,000

Premium paid- Rs.1000 for each stock | Rs.15,000

Expense incurred = Rs.6,78,000

Current trading price = Rs.43,800 x 15 = Rs.6,57,000

P&L= Rs.6,57,000 – Rs.6,78,000 = -Rs.21,000

You make a loss of Rs.21,000 in this deal. So the best thing to do is to walk away from the deal instead of honoring the contract.

Outcome 3: The price remains stable at Rs.44,200

If the stock price remains flat at Rs.44,200, it means that you are spending the premium extra just to acquire the stock for its market price.

You will make a loss of Rs.15,000 and won’t invoke your right to execute the contract.

If you’ve understood Options but still ponder why trading them is preferable to investing in stocks, allow me to elucidate the reasons for you. Let me clarify the advantages of choosing Options trading over stock investments.

- The only way to profit from a stock is by selling it when it is trading high. In Options, there are multiple ways to profit from any scenario. You can make money from the stocks going up, down, or even sideways.

- You can control a lot of shares with little capital investment. Although this is appealing, it comes with its own set of risks. In contrast, the chance of making a good profit with minimum capital is very low in stocks.

- As a pro Options trader, you will know your probabilities of making money from trading way ahead of time. So you keep your expectations based on that.

Characteristics of Options

Here are a few characteristics of Options that are important to keep in mind when trading.

Options Style: Every Options contract has an expiration date. It represents the end of the contract and the time when you decide if you want to exercise your right or not. Generally, it is the last Thursday of every month. There are two styles of Options- American style and European style. Both call and put American style Options can be exercised on or before the expiration date. On the other hand, European style Options can only be exercised on the expiration date.

Settlement: The settlement marks the conclusion of the risk transfer between the buyer and the seller, ultimately establishing the winners and losers in the transaction. There are two types of settlement namely physical and cash settlement. In the coming modules, we will learn more about these.

Premium: Just like margins in Futures, we pay ‘Premium’ in Options contracts. This is the non-refundable upfront fee that typically both buyers and sellers make for a lot.

Types of Options- Calls and Puts

Call Option: A call option is a financial contract that grants the holder the right, but not the obligation, to buy an underlying asset at a predetermined price within a specified period. Call options are used when investors anticipate the asset’s price will rise.

Put Option: A put option is a financial contract that provides the holder with the right, but not the obligation, to sell an underlying asset at a predetermined price within a specified time frame. Put options are employed when investors expect the asset’s price to fall.

Things to Know Before Starting Options Trading

If you are a beginner, here are a few factors to consider before you deep dive into Options trading.

- Options can be attached to a variety of securities like equities, indexes or ETFs.

- As an Options trader, you need to focus on the volatility of historical and implied data.

- When trading Options, you can profit from both Calls and Puts.

- Just like stock trading, drive a financial goal while trading Options.

Introduction to Call Option

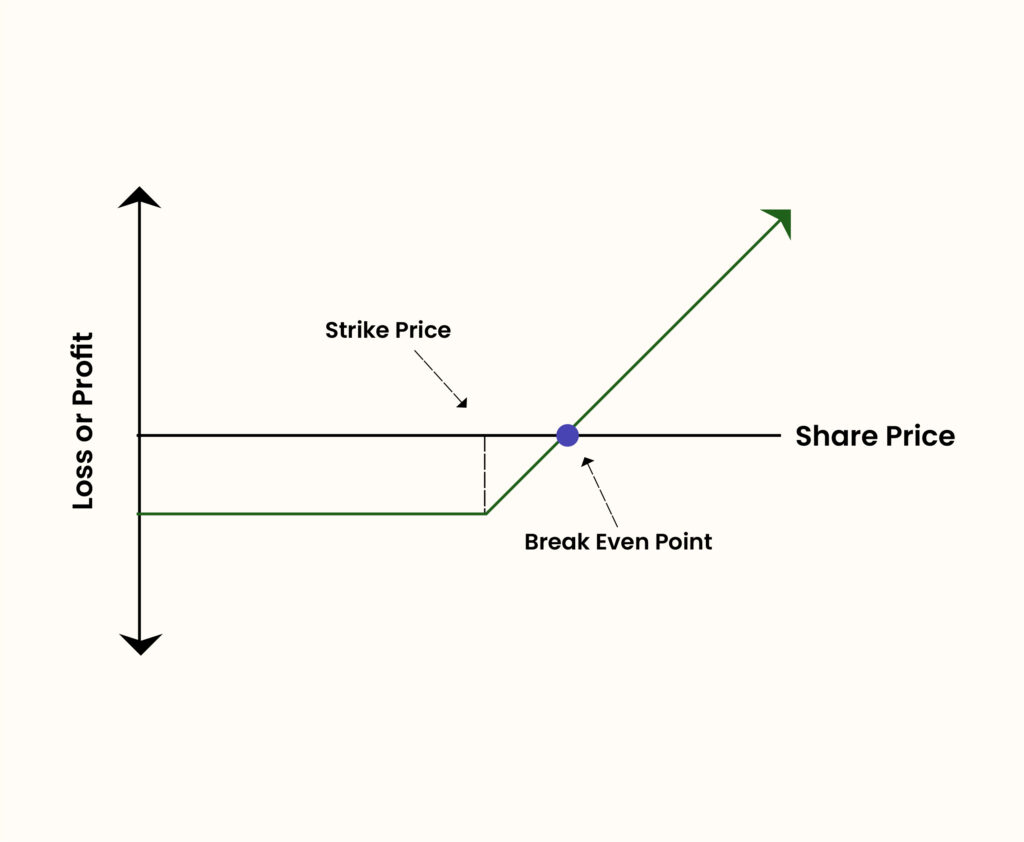

A call option grants the holder the right, but not the obligation, to purchase a specific quantity of an underlying asset at a predetermined price, known as the strike price, before a specified expiry date. After this date, the option to buy the asset lapses.

Investors often use call options to potentially profit from an asset’s price increase without owning it. If the asset’s price surpasses the strike price by the expiration date, the holder can opt to exercise the option, buying the asset at the lower strike price and realizing a profit. However, if the asset’s price fails to reach the strike price, the call option may expire worthless, resulting in a loss of the premium paid.

Let’s illustrate this with an example: Suppose ABC company’s stocks are priced at ₹50, and you purchase 100 call contracts at ₹3 premium each, with a strike price of ₹55. If, after a month, the shares are trading at ₹65, you could potentially profit ₹700 after deducting the premium paid.

Here’s how the calculation works:

Spot price minus Strike price equals ₹65 minus ₹55, which equals ₹10.

This difference represents the potential profit per share if you were to exercise your call option.

So, the total notional gain would be ₹10 multiplied by 100 contracts, which equals ₹1,000.

However, you need to account for the premium you paid for the call options. In this case, the premium is ₹3 per contract, so the total premium paid would be ₹3 multiplied by 100 contracts, which equals ₹300.

To calculate your total profit, you subtract the premium paid from the total notional gain. So, ₹1,000 minus ₹300 equals ₹700.

Therefore, if you were to exercise your call option after the stock price rises to ₹65, you could potentially realize a profit of ₹700.

In essence, call options offer leverage, allowing investors to control a larger asset position with less investment. While the profit potential is unlimited, the potential loss is limited to the premium paid, offering a hedge against market risks. Moreover, investors can close their position and exit the trade at any time.

Introduction to Put Options

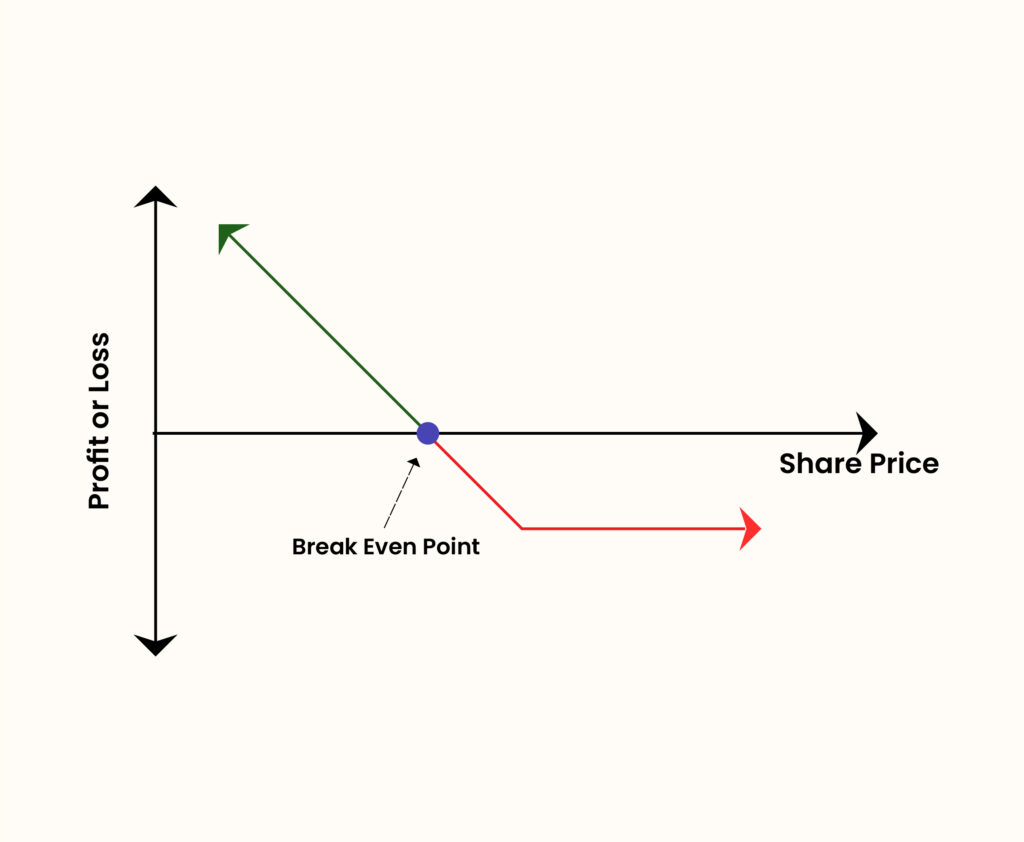

A put option grants the holder the right, though not the obligation, to sell a specific stock at a predetermined price (the strike price) by a specified time, known as the option’s expiration. The buyer pays the seller a premium for this right. Unlike stocks, options cease to exist at expiration, either retaining some value or expiring worthless.

Assume that ABC company’s stocks are currently trading at a spot price of ₹70 per share. You decide to buy 100 put contracts at a premium of ₹4 per contract, with a strike price of ₹65.

Now, let’s say the stock price of ABC company drops to ₹55 per share after a month. In this scenario, you may consider exercising your put option.

Here’s how the calculation would work:

Strike price minus Spot price equals ₹65 minus ₹55, which equals ₹10.

This difference represents the potential profit per share if you were to exercise your put option.

So, the total notional gain would be ₹10 multiplied by 100 contracts, which equals ₹1,000.

However, you need to account for the premium you paid for the put options. In this case, the premium is ₹4 per contract, so the total premium paid would be ₹4 multiplied by 100 contracts, which equals ₹400.

To calculate your total profit, you subtract the premium paid from the total notional gain. So, ₹1,000 minus ₹400 equals ₹600.

Therefore, if you were to exercise your put option after the stock price drops to ₹55, you could potentially realize a profit of ₹600.

Advantages of Put Options:

- Time Decay Advantage: Put sellers benefit from time decay as options lose value over time, favoring the seller over the buyer.

- Price Direction Advantage: Put option holders can profit from price drops or stability, unlike call option holders who require price increases.

- Implied Volatility Advantage: High implied volatility allows put option sellers to profit as prices drop over time. Traders can capitalize on decreasing volatility to generate profits.

Factors Affecting the Price of Options

Understanding the dynamics of option pricing is paramount in the realm of financial markets, where numerous factors influence the value of options. These elements serve as the guiding principles for investors navigating the complexities of options trading, shaping their strategies and decisions.

Using Options for Directional Strategies: Options offer versatile tools for implementing directional strategies, allowing traders to profit from bullish or bearish market movements. For instance, purchasing call options enables investors to benefit from price appreciation, while put options provide opportunities to capitalize on price declines.

Here are a few factors affecting Option prices:

Underlying Price: The value of options is closely tied to the underlying asset’s price movements, with call options thriving in rising markets and put options benefiting in declining markets.

Strike Price: This pivotal determinant establishes the price at which the option becomes profitable, allowing traders to fine-tune risk and reward profiles based on market predictions.

Option Type: Call and put options offer distinct strategic advantages, empowering traders to align positions with market expectations and navigate diverse market scenarios effectively.

Period Before Expiry: Time decay, influenced by the period before expiry, impacts option prices, urging traders to optimize positions based on their timeframe and strategy.

Interest Rates: Shifts in interest rates affect option pricing, altering their attractiveness relative to alternative investments and defining risk and reward profiles.

Dividends: Dividend payments impact option values, particularly for call options, necessitating strategic adjustments to navigate dividend-related fluctuations effectively.

Volatility: Volatility levels influence option prices, with higher volatility leading to increased option premiums and opportunities for traders to benefit from price swings.

Navigating options trading effectively demands a nuanced understanding of these factors, allowing investors to make informed decisions, manage risk, and increase the likelihood of achieving favorable outcomes in the dynamic options market.

Basic Strategies in Options Trading

Options, favored by traders, offer rapid price movements, leading to quick gains or losses. Strategies vary in complexity, from simple to intricate.

Despite complexity, strategies stem from two basic options: calls and puts. Here are a few popular options trading strategies. While lucrative, they entail risks. It’s essential to grasp call and put options basics beforehand.

- Call Ratio Spread: Buy one call, sell two higher strike calls; limited risk, potential profit if stock rises moderately, losses if stock rises significantly.

- Put Ratio Spread: Buy one put, sell two lower strike puts; limited profit, limited risk if correctly executed.

- Long Straddle: Buy call and put at same strike; profits from significant price movement in either direction.

- Long Iron Butterfly: Buy call and put spreads at same expiry; profits from minimal price movement.

- Long Strangle: Buy out-of-the-money call and put; profits from significant price movement in either direction.

- Long Iron Condor: Buy call and put spreads at different strikes; profits from minimal price movement.

- Strip: Buy two puts per call; profits from significant downward price movement.

- Strap: Buy two calls per put; profits from significant upward price movement.

- Short Straddle: Sell call and put at same strike; profits from minimal price movement.

- Iron Butterfly: Sell call and put spreads at same expiry; profits from minimal price movement.

- Short Strangle: Sell out-of-the-money call and put; profits from minimal price movement.

- Short Iron Condor: Sell call and put spreads at different strikes; profits from minimal price movement.

- Batman: Short put options, long call options to profit from upward price movement.

- Double Plateau: Selling two calls for every put sold to capitalize on stable stock prices.

- Jade Lizard: Selling put and call spreads to earn credit and minimize risk.

- Reverse Jade Lizard: Buying put and call spreads to earn credit and minimize risk.

- Buy Put: Purchase put option to profit from downward price movement; limited risk, unlimited potential profit.

- Sell Call: Sell call option to profit from stagnant or downward price movement; limited profit, unlimited risk.

- Bear Put Spread: Buy put, sell lower strike put; profits from downward price movement, limited risk.

- Bear Call Spread: Sell call, buy higher strike call; profits from stagnant or downward price movement, limited risk.

- Put Ratio Back Spread: Buy puts, sell lower strike puts; profits from significant downward price movement.

- Long Calendar With Puts: Buy long-term put, sell short-term put; profits from time decay, limited risk.

- Long Put Diagonal Spread: Buy long-term put, sell short-term put at different strikes; profits from time decay, limited risk.

- Bear Condor: Combination of bear call spread and bull put spread; profits from limited price movement.

- Bear Butterfly: Combination of bear call spread and bull call spread; profits from minimal price movement.

- Risk Reversal: Purchase call and sell put simultaneously; profits from upward price movement.

- Buy Call: Purchase call option to profit from upward price movement; limited risk, unlimited potential profit.

- Sell Put: Sell put option to profit from stable or upward price movement; limited profit, unlimited risk.

- Bull Call Spread: Buy call, sell higher strike call; profits from upward price movement, limited risk.

- Bull Put Spread: Sell put, buy lower strike put; profits from upward price movement, limited risk.

- Call Ratio Back Spread: Buy calls, sell higher strike calls; profits from significant upward price movement.

- Long Calendar With Calls: Buy long-term call, sell short-term call; profits from time decay, limited risk.

- Long Call Diagonal Spread: Buy long-term call, sell short-term call at different strikes; profits from time decay, limited risk.

- Bull Condor: Combination of bull put spread and bear call spread; profits from limited price movement.

- Bull Butterfly: Combination of bull put spread and bear put spread; profits from minimal price movement.

- Range Forward: Buy call and put options at different strikes to profit from price range.